In the vast landscape of commodities, where gold, silver, and platinum often steal the spotlight, one metal quietly but consistently makes headlines for its remarkable performance – rhodium. With its astonishing price surge in recent years, the Rhodium Market has become a focal point for investors, industrial players, and economists alike.

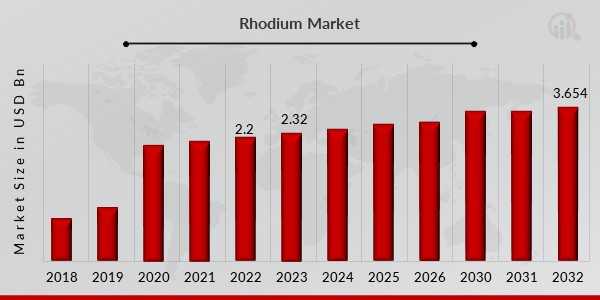

Rhodium Market was valued at USD 2.2 Billion in 2022 and is expected to reach USD 3.654 Billion by 2032, registering a CAGR of 5.80% during the forecast period of 2023-2032

Rhodium, a member of the platinum group metals (PGMs), possesses unique properties that make it indispensable in various industries, particularly automotive and chemical sectors. Its exceptional resistance to corrosion and catalytic properties render it essential in catalytic converters, crucial components in vehicle exhaust systems. Additionally, it finds applications in jewelry and electronics manufacturing.

The Rhodium market has historically been characterized by its volatility, largely due to its limited supply and unpredictable demand dynamics. South Africa remains the primary producer of rhodium, with Russia and Zimbabwe contributing as well. The extraction process, often alongside other PGMs like platinum and palladium, is complex and costly, further constraining its availability.

However, what truly sets the rhodium market apart in recent times is its staggering price rally. Beginning around 2017, rhodium embarked on an unprecedented upward trajectory, defying conventional market expectations. From trading at around $600 per ounce at the start of the decade, prices skyrocketed to over $20,000 per ounce by early 2021, marking an exponential increase of over 3000%.

Several factors have fueled this meteoric rise. Firstly, tightening emission standards worldwide have spurred demand for rhodium in catalytic converters, particularly in gasoline-powered vehicles. Stricter regulations in major automotive markets like Europe and China have necessitated greater usage of PGMs to curb harmful emissions, boosting rhodium's demand.

Secondly, supply-side challenges have exacerbated the price surge. Declining ore grades, labor disputes, and operational disruptions in key producing regions have constrained rhodium output, leading to supply deficits. Moreover, the COVID-19 pandemic exacerbated these supply chain disruptions, further amplifying the metal's scarcity.

Thirdly, speculative investment activity has played a significant role in driving rhodium prices to unprecedented levels. Investors seeking higher returns amid global economic uncertainties have turned to commodities, including rhodium, as a hedge against inflation and currency devaluation. The limited liquidity and relatively small market size of rhodium have magnified its susceptibility to speculative trading, contributing to price volatility.

Despite its remarkable price rally, the rhodium market remains inherently volatile and subject to various risk factors. Fluctuations in automotive production, technological advancements reducing PGM usage, and geopolitical tensions in key producing regions all pose challenges to the market's stability.

Looking ahead, the outlook for the rhodium market remains optimistic yet cautious. While demand for rhodium in automotive applications is expected to remain robust, advancements in electric vehicle technology and shifting consumer preferences towards greener alternatives could pose long-term challenges. Moreover, geopolitical tensions and supply chain disruptions continue to loom large over the market, warranting careful monitoring.

In conclusion, the rhodium market's remarkable ascent has captivated the attention of investors and industry stakeholders worldwide. Its unique properties, coupled with surging demand and supply constraints, have propelled prices to unprecedented heights. However, the market's inherent volatility and various risk factors underscore the importance of prudent risk management strategies for participants navigating this intriguing yet unpredictable landscape.

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis of diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com