In an era where healthcare costs are skyrocketing, long term care insurance has emerged as a vital tool to safeguard individuals and their families against the financial burden associated with nursing home care. With the peace of mind it offers, long term care insurance is quickly gaining popularity among those planning for their future.

Long term care insurance offers financial protection for those needing aid with daily tasks like bathing, dressing, and eating due to chronic illnesses, disabilities, or age-related conditions.

Unlike traditional health insurance, long term care insurance is not focused on medical treatment, but rather on the assistance needed with daily activities. It is important to note that long term care insurance typically does not cover pre-existing conditions or conditions that are already being treated at the time of application. However, it can provide coverage for a wide range of conditions, including Alzheimer's disease, Parkinson's disease, and other chronic illnesses.

Long term care insurance policies typically have a waiting period before benefits are paid out, known as the elimination period. This waiting period can range from 30 to 180 days, depending on the policy. It is important to carefully review the terms and conditions of a policy to understand the waiting period and any other limitations or exclusions.

With a range of policy options available, individuals can customize their long term care insurance to suit their specific needs and budget. In a world where unexpected health challenges can arise at any time, long term care insurance offers the assurance of financial protection and peace of mind.

Ensure your peace of mind by exploring the benefits of long term care insurance for nursing homes today.

Key Benefits of Long Term Care Insurance for Nursing Homes

- Financial Protection: One of the primary benefits of long term care insurance for nursing homes is the financial protection it offers. With the high costs associated with nursing home care, having insurance coverage can help prevent individuals and their families from depleting their life savings or going into debt to pay for care. Long term care insurance ensures that individuals have the means to afford the care they need without sacrificing their financial security.

- Choice and Independence: Another key benefit of long term care insurance is the ability for individuals to maintain their independence and make choices about their care. By having insurance coverage, individuals have the freedom to choose the nursing home facility that best suits their needs and preferences. This can be especially important for individuals who have specific care requirements or who want to be closer to family and friends. Long term care insurance enables individuals to retain autonomy over their lives by allowing them to make informed decisions about their care.

- Reduced Burden on Family: Long term care insurance can also reduce the burden on family members who might otherwise have to provide care or make difficult care-related decisions. By having insurance coverage, individuals can alleviate the pressure on their loved ones and ensure that their care needs are met by professionals in a nursing home facility. This can help preserve family relationships and prevent the emotional and physical strain that often comes with being a caregiver.

- Peace of Mind: Perhaps the most important benefit of long term care insurance for nursing homes is the peace of mind it provides. Knowing that one has insurance coverage in place to pay for care can alleviate the stress and anxiety associated with the uncertainty of the future. Long term care insurance offers individuals the reassurance that their needs will be met and they will receive quality care in a reputable nursing home facility.

The Importance of Long Term Care Insurance for Nursing Homes

- Nursing home care can be incredibly expensive, with costs averaging thousands of dollars per month. Without proper planning or insurance coverage, individuals and their families may be faced with the daunting task of paying for these costs out of pocket. This can quickly deplete savings and assets, leaving individuals financially vulnerable.

- Long term care insurance provides an important safety net for individuals who anticipate the need for nursing home care in the future. By paying regular premiums, individuals can ensure that they have coverage in place to help alleviate the financial burden of nursing home expenses.

- In addition to financial protection, long term care insurance offers individuals the ability to maintain their independence and make choices about their care. This can be particularly important for individuals who may require long term care due to a chronic illness or disability. By having the means to pay for care in a reputable nursing home facility, individuals can have peace of mind knowing that their needs will be met and they will receive proper care.

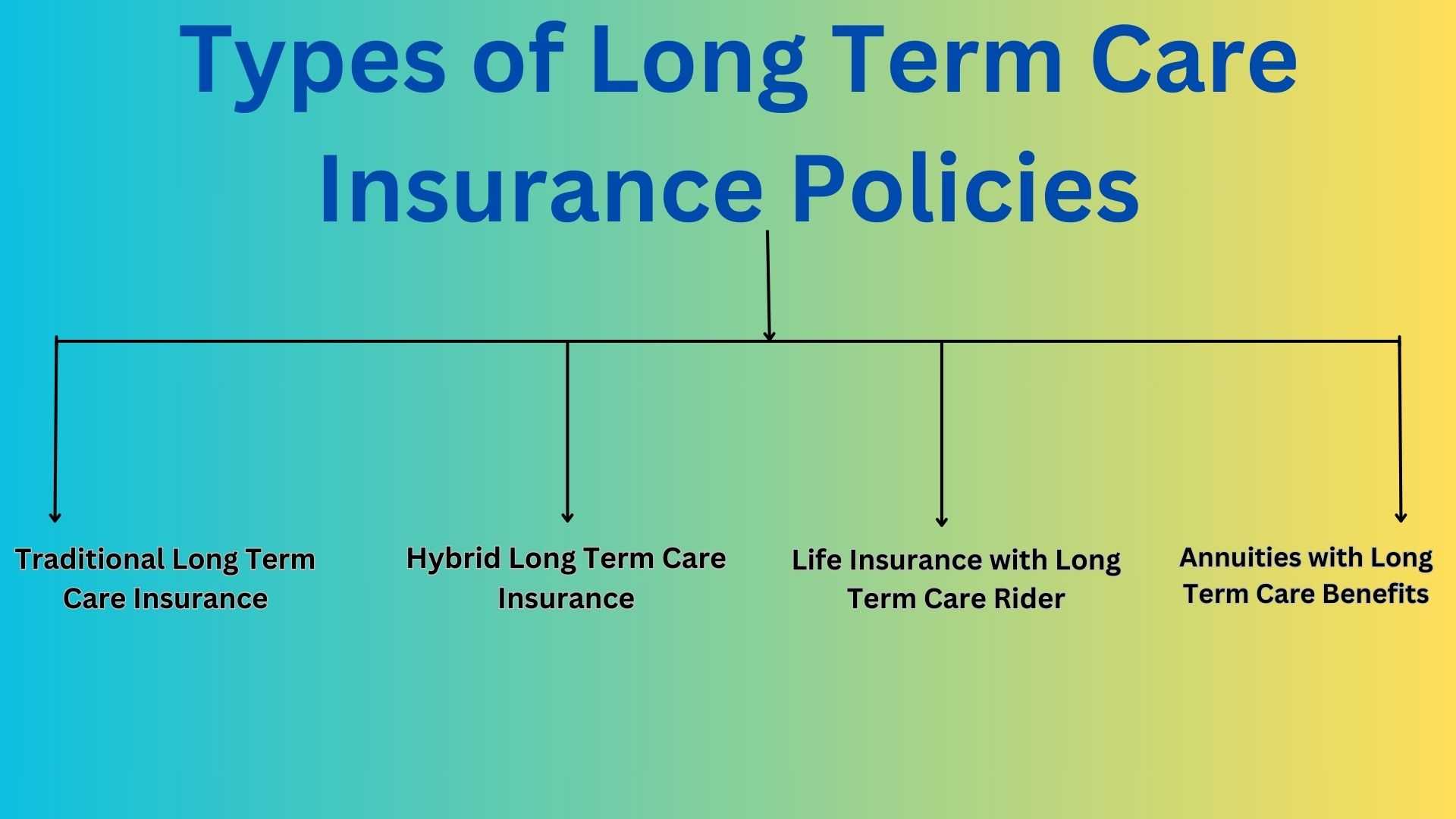

Exploring Different Types of Long Term Care Insurance Policies

When it comes to long term care insurance, there are several different types of policies available. Each type of policy has its own features, benefits, and limitations, so it is important to understand the options before making a decision. Here are some of the most common types of long term care insurance policies:

- Traditional Long Term Care Insurance: This type of policy provides coverage for long term care services in a nursing home, assisted living facility, or home care setting. It typically pays a daily or monthly benefit amount for a specified period of time, such as three years or five years. Traditional long term care insurance policies can be customized to meet individual needs and budgets, with options for inflation protection and additional riders for enhanced coverage.

- Hybrid Long Term Care Insurance: Hybrid policies merge long term care insurance with another form of insurance, like life insurance or an annuity. These policies provide a death benefit or a cash value if long term care services are not needed. Hybrid policies can be more expensive upfront but offer the advantage of providing some financial benefit even if long term care services are not utilized.

- Life Insurance with Long Term Care Rider: Some life insurance policies offer the option to add a long term care rider. This allows individuals to access a portion of the death benefit to pay for long term care services if needed. Life insurance with a long term care rider can be a cost-effective way to obtain long term care coverage while providing a death benefit to beneficiaries if long term care services are not required.

- Annuities with Long Term Care Benefits: Annuities are financial products that provide a stream of income over a specified period of time or for the rest of an individual's life. Some annuities offer the option to add a long term care benefit rider, which provides additional income to pay for long term care services. Annuities with long term care benefits can be a good option for individuals who are looking for both income and long term care coverage.

It is important to carefully review the terms and conditions of each type of policy before making a decision. Consider factors such as premium costs, benefit amounts, waiting periods, and any limitations or exclusions. Consulting with a financial advisor or insurance professional can help individuals navigate the options and choose the policy that best meets their needs.

Factors to Consider When Choosing a Long Term Care Insurance Policy for Nursing Homes

Choosing the right long term care insurance policy for nursing home care requires careful consideration of several factors. Here are some key factors to keep in mind when evaluating different policies:

- Premium Costs: Long term care insurance premiums can vary widely based on factors such as age, health, and the level of coverage selected. It is important to assess the affordability of premiums and ensure that they fit within the budget. However, it is equally important to consider the potential cost of nursing home care without insurance and the financial impact it could have on savings and assets.

- Benefit Amounts: Different policies offer different benefit amounts, which can range from a fixed daily or monthly amount to a percentage of the actual cost of care. It is important to consider the average cost of nursing home care in the desired location and choose a policy that provides sufficient coverage. Keep in mind that the cost of care may increase over time due to inflation, so it may be wise to consider policies with inflation protection.

- Waiting Period: Long term care insurance policies typically have a waiting period before benefits are paid out, known as the elimination period. This waiting period can range from 30 to 180 days, depending on the policy. It is important to understand the waiting period and assess whether it aligns with personal financial resources or other sources of support during that time.

- Coverage Options: Long term care insurance policies can offer different coverage options, such as coverage for nursing home care only, or coverage for a combination of nursing home care, assisted living, and home care. It is important to choose a policy that aligns with personal preferences and anticipated care needs. Consider factors such as the proximity of nursing home facilities, the availability of home care services, and personal preferences for the type of care received.

- Inflation Protection: Inflation protection is an important consideration when selecting a long term care insurance policy. Without inflation protection, the benefit amount may not keep pace with the rising cost of care over time. Some policies offer an inflation protection rider that increases the benefit amount each year to account for inflation. This can help ensure that the policy provides sufficient coverage even in the future.

- Insurance Company Reputation: When purchasing long term care insurance, it is important to choose a reputable insurance company with a strong financial rating. Look for companies that have a history of honoring claims and providing quality customer service. Research customer reviews and ratings to get a sense of the company's reputation and reliability.

By considering these factors and carefully evaluating different long term care insurance policies, individuals can make an informed decision that provides the best coverage for their nursing home care needs.

How Long Term Care Insurance Can Provide Financial Security for Nursing Home Care

Long term care insurance provides individuals with the financial security they need to afford nursing home care without depleting their life savings. Here are some ways in which long term care insurance can provide financial security for nursing home care:

- Protection of Assets: Nursing home care can be incredibly expensive, with costs averaging thousands of dollars per month. Without insurance coverage, individuals and their families may be forced to pay for these costs out of pocket, potentially depleting savings and assets. Long term care insurance helps protect assets by providing coverage for the cost of care, allowing individuals to preserve their financial security.

- Preservation of Inheritance: Long term care insurance can also help preserve an individual's inheritance for their beneficiaries. By having insurance coverage in place to pay for nursing home care, individuals can avoid the need to use their assets to cover these costs. This ensures that their loved ones receive the intended inheritance, rather than it being spent on long term care expenses.

- Income Replacement: For individuals who rely on income from investments or retirement savings, long term care insurance can provide income replacement in the event that nursing home care is needed. By paying out a benefit amount to cover the cost of care, the insurance policy can help individuals maintain their standard of living and continue to meet their financial obligations.

- Medicaid Planning: Long term care insurance can also play a role in Medicaid planning. Medicaid is a government program that provides healthcare coverage for individuals with limited income and assets. By having long term care insurance, individuals can potentially delay the need to rely on Medicaid for nursing home care, allowing them to preserve their assets for other needs or to pass on to their heirs.

It is important to note that long term care insurance policies have certain limitations and exclusions, so it is essential to carefully review the terms and conditions of a policy before purchasing. Working with a financial advisor or insurance professional can help individuals understand the financial security provided by long term care insurance and make the best decision for their needs.

Common Misconceptions about Long Term Care Insurance for Nursing Homes

There are several common misconceptions about long term care insurance for nursing homes that can prevent individuals from exploring this important coverage option. Here are some of the most common misconceptions and the truths behind them:

- Medicare Will Cover Nursing Home Care: Many people mistakenly believe that Medicare will cover the cost of nursing home care. While Medicare does provide some coverage for short-term skilled nursing care, it does not cover the long-term care services typically provided in a nursing home. Long term care insurance is specifically designed to cover these types of services and can provide the necessary financial protection.

- I'm Young and Healthy, I Don't Need Long Term Care Insurance: Long term care insurance is often associated with older individuals or those with chronic illnesses. However, the need for long term care can arise at any age due to accidents, disabilities, or unexpected health challenges. By purchasing long term care insurance at a younger age, individuals can secure coverage at a more affordable rate and ensure they are protected in the event of future care needs.

- Long Term Care Insurance is Too Expensive: While long term care insurance premiums can vary based on factors such as age and health, there are affordable options available. By carefully considering coverage needs and budget, individuals can find a policy that offers the necessary protection without breaking the bank. It is important to weigh the potential costs of nursing home care without insurance against the premiums of a policy to understand the true value of long term care insurance.

- I Can Rely on Family to Provide Care: While it is true that some individuals may have family members who are willing and able to provide care, it is important to consider the potential physical, emotional, and financial strain that can come with being a caregiver. Long term care insurance can help alleviate this burden by providing coverage for care in a nursing home facility, allowing family members to maintain their own lives and relationships.

- I Can Wait Until I Need Care to Purchase Long Term Care Insurance: Long term care insurance is typically easier to obtain and more affordable when purchased at a younger age and in good health. Waiting until care is needed can result in limited insurance options or higher premiums due to age or health conditions. By planning ahead and purchasing long term care insurance early, individuals can secure coverage and protect their financial future.

It is important to separate fact from fiction when considering long term care insurance for nursing homes. By understanding the truths behind common misconceptions, individuals can make informed decisions about their insurance needs and ensure they have the necessary coverage in place.

Conclusion: The peace of mind that comes with long term care insurance for nursing homes

Long term care insurance for nursing homes offers individuals and their families the peace of mind that comes from knowing they have financial protection against the high costs of care. This insurance allows individuals to maintain their independence, make choices about their care, and access high-quality services in a reputable nursing home facility.

By exploring the benefits of long term care insurance, individuals can ensure that their needs are met and their financial resources are protected. With a range of policy options available, it's important to carefully consider individual needs and budget when choosing a long term care insurance policy for nursing homes.

Start planning for the future today by exploring the benefits of long term care insurance for nursing homes. With the assurance of financial protection and peace of mind, individuals can face the future with confidence and security.